high demand for luxury watches

Luxury watches are in demand as alternative investments. The explosive development of the luxury watch market over the past 10 years has created a $22 billion secondary watch market. Due to the scarcity, buyers are willing to pay significant premiums for preowned models from renowned brands like Rolex, Patek Philippe, and Audemars Piguet, as well as from notable independents such as F.P.Journe, anticipating a continued increase in their value. The growing global middle and upper class is also driving this demand, as more people seek luxury items both as status symbols and as reliable stores of value. As these demographics expand, scarcity is expected to become even more pronounced, driving prices and competition for high-quality watches even higher in the future.

The process

1. Buy

We work closely with you to define your ideal investment size and time horizon, tailoring every step of the process to your unique financial goals and personal aspirations. We help you curate a bespoke portfolio that aligns with your vision.

2. Hold

Keep the watches securely stored in Investment Watches' highly protected vault, or select your own preferred storage option during the agreed investment period

3. Sell

You can either sell the watches through Investment Watches, extend the investment period, or retain the watches for personal use or further investment

Multible storage options

When it comes to storing valuable watches, you have several options, including using Investment Watches' vault or opting for personal storage. Here's a breakdown of both options:

Store at Investment Watches

- High Security: Advanced security measures like 24/7 surveillance and AI-Powered

Age & Identity Verification Technology - Insurance Ease: Recognized security standards make insurance simpler.

- Climate Control: Protects watches from humidity, temperature, and dust damage.

- Convenience: Easy access without personal maintenance responsibilities.

Store at home

- Full Control: Immediate, anytime access to your collection.

- Security Risk: Storing valuable watches at home increases the risk of theft.

- Insurance complexity: Insuring watches stored at home might require additional premiums or more complex coverage due to the higher risk involved.

Why watches are a great investment

Luxury watches, particularly those from prestigious brands with limited editions or historical significance, have consistently appreciated in value over time. While the stock market can be volatile, certain luxury watches often maintain or steadily increase their value, making them a more stable investment option. The supply of luxury watches is limited by factors such as production capacity, craftsmanship, and controlled distribution agreements. Simultaneously, the demand for luxury watches continues to grow, driven by increasing affluence, global economic growth, and aspirational consumption in emerging markets. This limited supply and growing demand contribute to the appreciation of luxury watches as collectible items and investment assets.

learn more

Tangible asset

Luxury watches offer the advantage of being tangible assets that investors can hold, display, and enjoy. Unlike stocks or real estate, which may require complex ownership structures or maintenance, luxury watches are relatively easy to store, transport, and liquidate when needed. Investing in luxury watches can provide diversification benefits to an investment portfolio. Since luxury watches often have low correlation with traditional asset classes such as stocks, their value may not move in tandem with broader market trends. By adding luxury watches to a diversified portfolio, investors can potentially reduce overall portfolio risk and enhance long-term returns.

Learn more

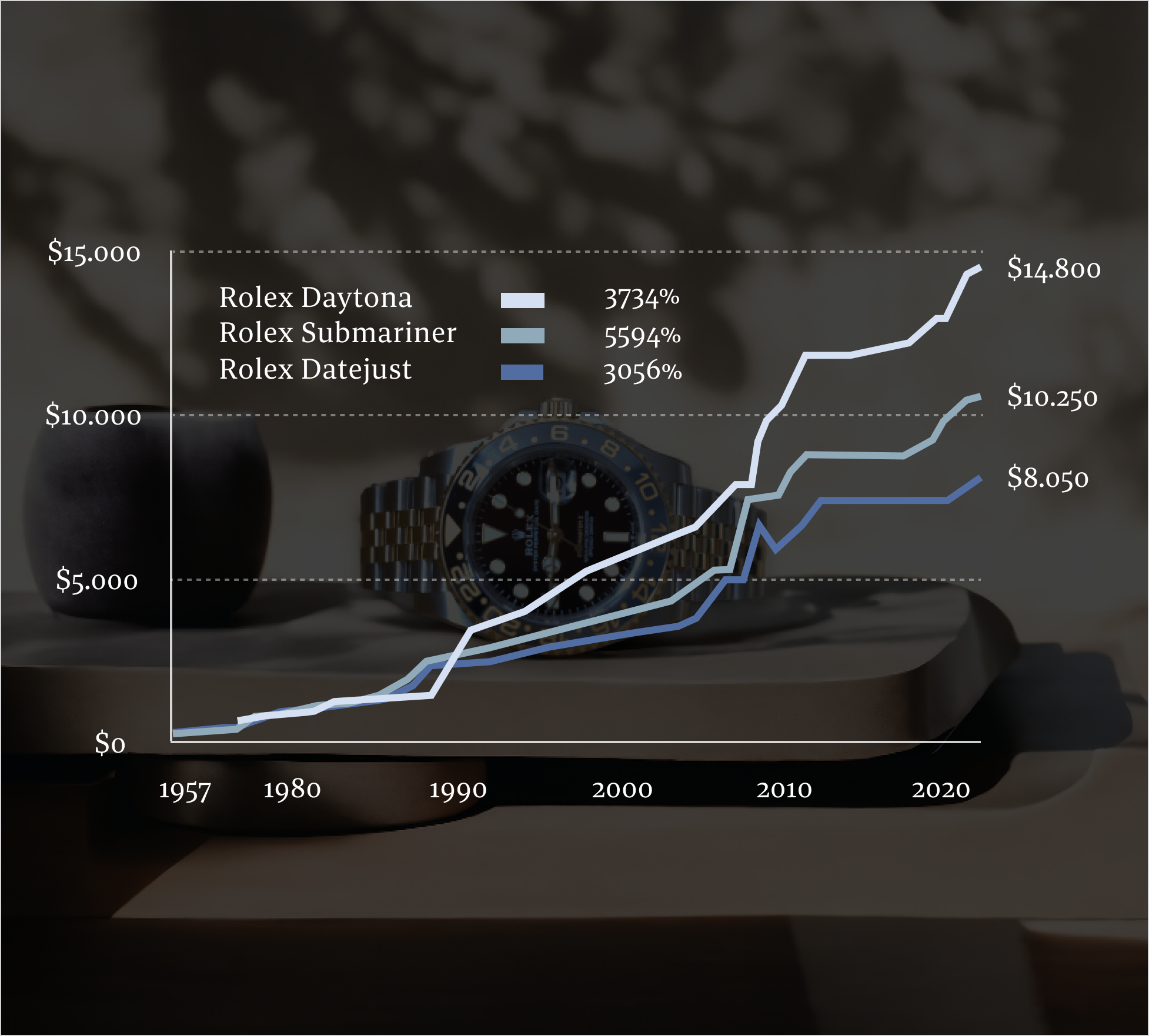

Strong historical increase in price

The prices of top models from Rolex have been increasing for the past 67 years.

Furthermore, the Chrono24 price index of Patek Philippe (+86%), Audemars Piguet (+98%) & Rolex (+52%) have increased in the past 5 years (Updated September 2024)

Book discovery callNeed help?

Frequently Asked Questions

We accept a variety of cryptocurrencies for payments, including:

1Bitcoin (BTC)

Bitcoin Cash (BCH)

Ethereum (ETH)

Wrapped Bitcoin (WBTC)

Dogecoin (DOGE)

Litecoin (LTC)

Solana (SOL)

XRP (Ripple)

USD-pegged stablecoins like:

- USD Coin (USDC)

- Binance USD (BUSD)

- Gemini Dollar (GUSD)

- Pax Dollar (USDP)

- Dai (DAI)

If you are looking to invest with another currency, please take contact.

You can opt to keep the watches securely stored at Investment Watches in a highly protected environment, or you have the freedom to select your preferred personal storage option.

We provide investment opportunities in a wide array of luxury watch brands, including renowned names such as Rolex, Patek Philippe, and Audemars Piguet. Additionally, we offer options for investment in alternative luxury watch brands such as Richard Mille, Vacheron Constantin, F.P. Journe, and Cartier. Our experienced team will expertly guide you through the investment process, leveraging our proven track record in the industry.

The quantity of watches within your portfolio is contingent upon the scale of your investment. Our objective is to ensure that multiple timepieces are included in each portfolio.

To optimize returns, we advise a minimum investment period of two years for investments in luxury watches. Our portfolio options typically span investment periods of 2, 3, 5, or 10 years. Upon the expiration of the initial period, portfolios may be extended as desired.

Yes, you will have access to your watches and can pick them up any day you would like.

Yes. Portfolio investment can be made by companies or private individuals.

Upon conclusion of the investment period, the buyer is presented with multible options:

- Sell the watches at the optimal price, facilitated by Investment Watches , with pricing agreed upon in advance with the portfolio owner.

- Opt to extend the investment period for the portfolio.

- Retain the watches for personal use or further investment.